Article Directory

The data points are stacking up, folks, and if you’re still talking about blockchain as a fringe curiosity, you’re missing the forest for the trees. What we’re witnessing isn't just a trend; it's a structural shift, a quiet but persistent re-architecture of how capital moves. Wall Street isn't just dipping a toe; it’s building bridges, and some of them are already handling serious traffic.

The Numbers Talk: Profitability Meets Potential

Let’s start with what’s actually working, because that’s where the smart money is always looking. Figure Technology Solutions, Inc. (FIGR) isn't some vaporware startup; it’s a blockchain business that’s profitable. In Q3, they pulled in $156.4 million in revenue. That’s a 55% jump year-over-year, exceeding what Wall Street analysts expected. When you see numbers like that, driven by "ecosystem and technology fees," and hear about adjusted EBITDA margins north of 50%, you don’t just shrug. You lean in. This isn’t just growth; it’s efficient, high-margin growth, and it suggests a real, revenue-generating product that’s found its market. They’re launching a new crypto exchange, too, which only solidifies their position in this hybrid financial landscape.

But FIGR isn’t the only signal. Look at HelloTrade. This isn't a bunch of crypto maximalists coding in a garage. We’re talking about a mobile-first, blockchain-powered trading platform co-founded by Kevin Tang and Wyatt Raich. These aren’t just names; these are former BlackRock digital assets heavyweights. They didn’t just work at BlackRock; they were instrumental in pivoting that behemoth from outright crypto skepticism to launching ETFs like the iShares Bitcoin Trust (IBIT) and iShares Ethereum Trust (ETHA)—products that saw record debuts. That’s like saying someone helped redesign the Queen Mary to run on jet fuel. They know how to move institutional weight.

HelloTrade just raised $4.6 million in a first funding round from serious players like Dragonfly Capital and Mirana Ventures. Their goal? To make traditional assets—U.S. stocks, commodities—globally accessible via crypto technology, and yes, they’re adding perpetual futures to the mix. They’re not just chasing the next meme coin; they’re trying to put the entire existing financial apparatus on a new rails system. And this is the part of the report that I find genuinely puzzling: they’re talking about launching by late 2025 or early 2026, with only about ten employees. That’s an ambitious timeline for a project of this scope, especially when you’re talking about the kind of product safety and security needed for traditional assets. It makes you wonder about the precise methodology for their development roadmap, doesn’t it? Are we talking minimal viable product, or a full-fledged institutional-grade platform by then?

The Great Convergence: Wall Street's Blockchain Bet

The story here isn't just about individual companies; it's about the tectonic plates of finance grinding against each other and then, inevitably, merging. Tang and Raich’s journey from BlackRock to HelloTrade isn't an anomaly; it's indicative of a broader trend. Andreessen Horowitz’s crypto arm noted that a significant portion of new talent entering the crypto sector comes directly from traditional finance backgrounds. It’s not just a brain drain; it’s a brain reallocation, a recognition that the future of finance, at least in part, is going to be built on distributed ledgers.

You’ve got major banks like JPMorgan and Goldman Sachs, typically cautious, now developing their own blockchain technology. This isn't charity; it's a strategic investment in efficiency and new market opportunities. President Trump’s friendly policies towards the sector since last year’s election only accelerate this. Political tailwinds, institutional expertise, and demonstrable profitability—that’s a potent cocktail.

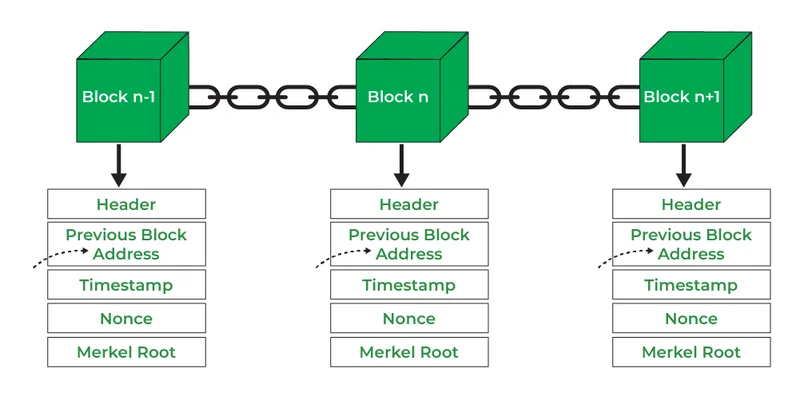

Think of it like this: Wall Street has always been a colossal, intricate clockwork machine, each gear perfectly meshed, albeit sometimes slowly. Crypto, on the other hand, burst onto the scene like a hyper-efficient, decentralized digital stopwatch. Now, the engineers from the clockwork factory are not just observing the stopwatch; they’re actively integrating its mechanisms into their own system. It’s a complex, delicate operation, full of potential friction, but the promise of increased speed, transparency, and global reach is too compelling to ignore. They call it the "next frontier of blockchain adoption," and while that sounds like marketing speak, the underlying data points—the revenue growth, the institutional capital, the talent migration—suggest they might just be right. How much more efficient can these new systems actually be, and what’s the quantifiable impact on transaction costs and settlement times that truly justifies this massive shift? That's the real question.

The Inevitable Integration: Data-Driven Reality

The planned 2026 IPO for Blockchain.com, coupled with the proven profitability of FIGR and the serious institutional backing for ventures like HelloTrade, paints a clear picture. This isn't about speculation anymore; it’s about the integration of blockchain technology into the very fabric of global finance. The data, from revenue growth to talent migration, points to an undeniable conclusion: the line between "traditional" and "crypto" finance is blurring into irrelevance. The smart money isn’t asking if this is happening, but how fast and to what extent the existing structures will be transformed.