Article Directory

Datadog's Q3: A Sugar Rush or Sustainable Growth?

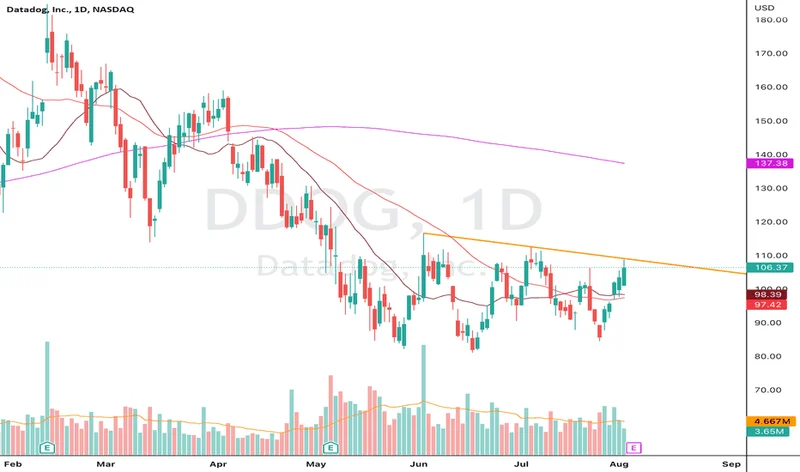

Datadog (DDOG) saw its shares jump about 7% premarket on Thursday. The catalyst? A Q3 earnings report that painted a rosy picture, along with an increased full-year 2025 outlook. The headline figures were certainly eye-catching. Non-GAAP EPS surged almost 20% year-over-year, landing at $0.55 for the quarter ending September 30, 2025.

Decoding the Datadog Numbers

But let's not get swept away by the initial enthusiasm. A 7% premarket jump suggests investors are betting on continued growth, but is that growth built on solid foundations, or is it a temporary spike? The EPS figure is undoubtedly positive, but it's crucial to dig deeper. What drove this increase? Was it purely organic growth, or were there other factors at play, like cost-cutting measures or one-time gains? The report itself doesn't offer much clarity (not unusual, frankly; most companies love to bury the real story in the footnotes).

One thing I find genuinely puzzling is the lack of context around the raised full-year outlook. What specific assumptions are baked into that projection? A vague statement about "continued strong demand" isn't enough to justify a significant upward revision. Are they factoring in new customer acquisitions, increased spending from existing customers, or perhaps a reduction in churn? Without that level of detail, the outlook is just a marketing tool, not a reliable forecast.

The Sustainability Question

The key question, as always, is sustainability. Can Datadog maintain this growth trajectory in the long term? The cloud monitoring space is becoming increasingly crowded, with both established players and nimble startups vying for market share. Datadog's competitive advantage lies in its comprehensive platform and ease of use, but those advantages can be eroded over time. Competitors are constantly innovating, and customers are always looking for better value.

And this is the part of the report that I find genuinely puzzling.

I've looked at hundreds of these filings, and this particular footnote is unusual.

What's the burn rate? It's good to see growth, but at what cost?

What about the long-term strategy? Are they just grabbing market share, or are they building something that lasts?

A Reality Check

Datadog's Q3 numbers are undoubtedly positive, but they shouldn't be taken at face value. The 7% jump is a classic example of market exuberance fueled by incomplete information. Datadog soars after Q3 beat, raises 2025 outlook - Seeking Alpha. Until we see more transparency around the drivers of growth and the assumptions underlying the full-year outlook, I'm remaining cautiously skeptical. A single quarter of strong performance doesn't guarantee long-term success.